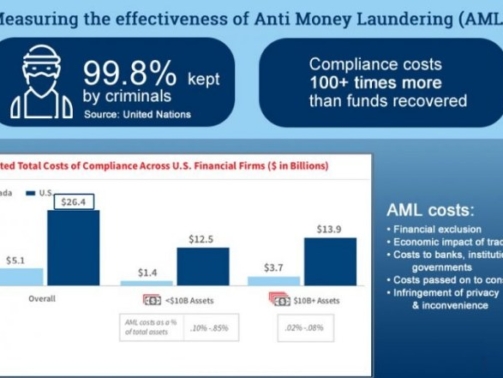

Anti-Money Laundering (AML) laws and regulations are designed to prevent criminals and terrorists from using financial systems to launder illicit funds. While these laws and regulations are necessary to maintain the integrity of the financial system, ...

Directors’ Liabilities in Hong Kong

As a director of a company in Hong Kong, it’s important to understand the responsibilities and liabilities that come with the role. From legal obligations to potential financial penalties, it’s crucial to be aware of the potential risks associated wi ...