When setting up a company in Hong Kong, one of the key decisions to make is where to register the company’s address. While it is a legal requirement to have a registered address, it is important to understand that the registered address does not necessarily equate to the effective place of management. In this article, we will explore why having a registered address in Hong Kong does not necessarily mean that the effective place of management is also in Hong Kong.

What is a Registered Address?

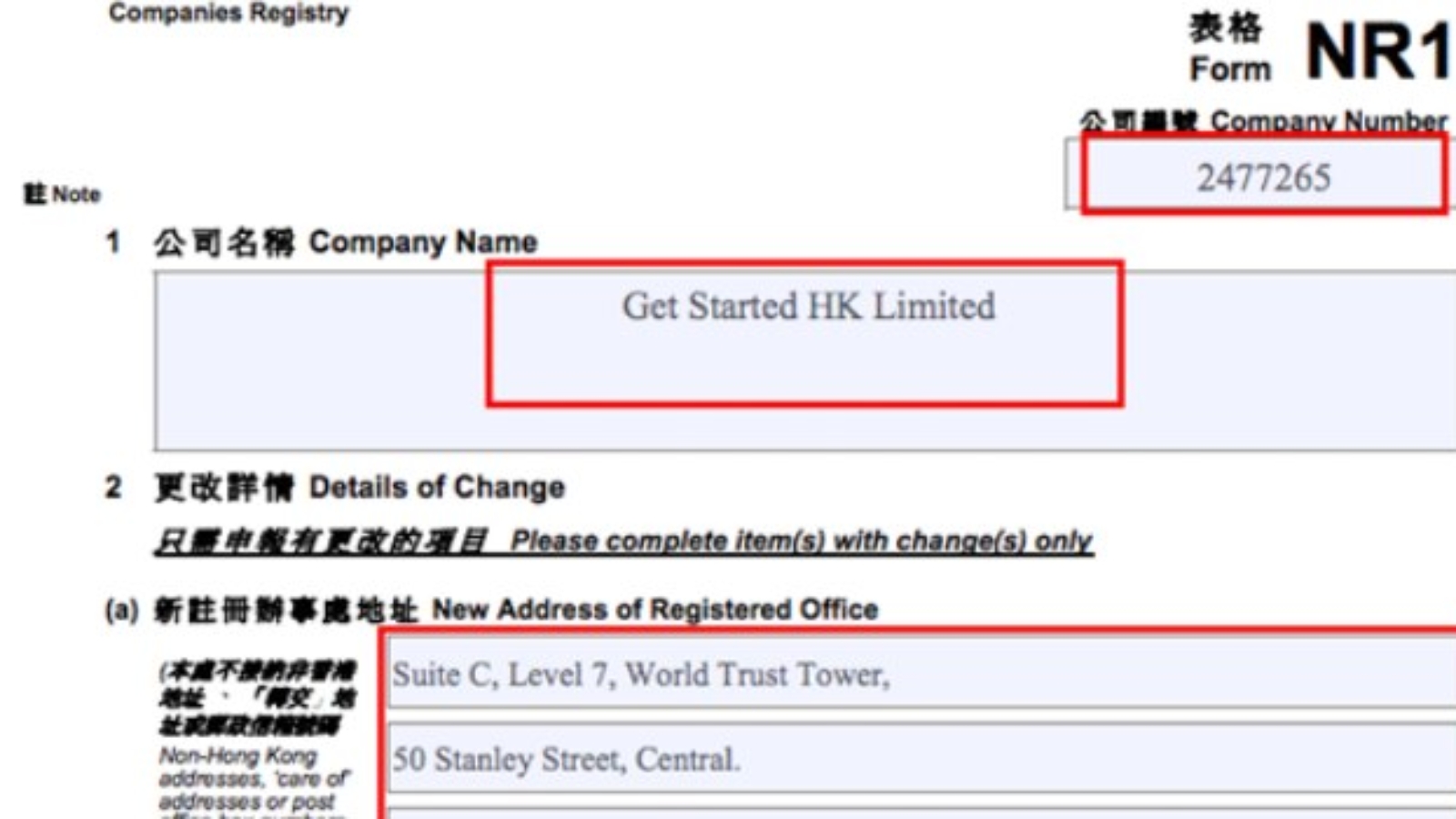

A registered address is the official address of a company as recorded with the Companies Registry in Hong Kong. It is the address to which all official correspondence from the government will be sent, and it must be a physical address within Hong Kong. The registered address is also where the company’s statutory records, such as the company’s register of members and register of directors, must be kept.

What is the Effective Place of Management?

The effective place of management is the place where the company’s key management and control decisions are made. This can include decisions such as strategic planning, financial management, and operational management. The effective place of management is an important concept because it determines where the company is considered to be tax resident and subject to taxation.

Why Registered Address is not the Same as Effective Place of Management

While the registered address is a physical address in Hong Kong, it does not necessarily mean that the effective place of management is also in Hong Kong. The effective place of management is determined by various factors such as the location of the company’s directors, the location of the company’s key decision-makers, the location of the company’s central administration, and the location of the company’s board meetings.

For example, if a company’s board of directors is based outside of Hong Kong, and they make all the key management and control decisions from outside of Hong Kong, then the effective place of management is not in Hong Kong. This means that the company may not be considered a tax resident in Hong Kong and may not be subject to taxation in Hong Kong.

Conclusion

In conclusion, having a registered address in Hong Kong is a legal requirement for companies operating in the region. However, it is important to understand that the registered address does not necessarily equate to the effective place of management. The effective place of management is determined by various factors such as the location of the company’s directors and key decision-makers. Companies must ensure that they are compliant with the tax laws of the jurisdictions in which they operate and must take steps to ensure that their effective place of management is in the correct location.