Hong Kong banks have been increasingly requesting customers to provide their Tax Identification Number (TIN) during the account opening process. While this may seem like an unnecessary extra step, there are important reasons why banks in Hong Kong are requesting your TIN number.

What is a Tax Identification Number (TIN)?

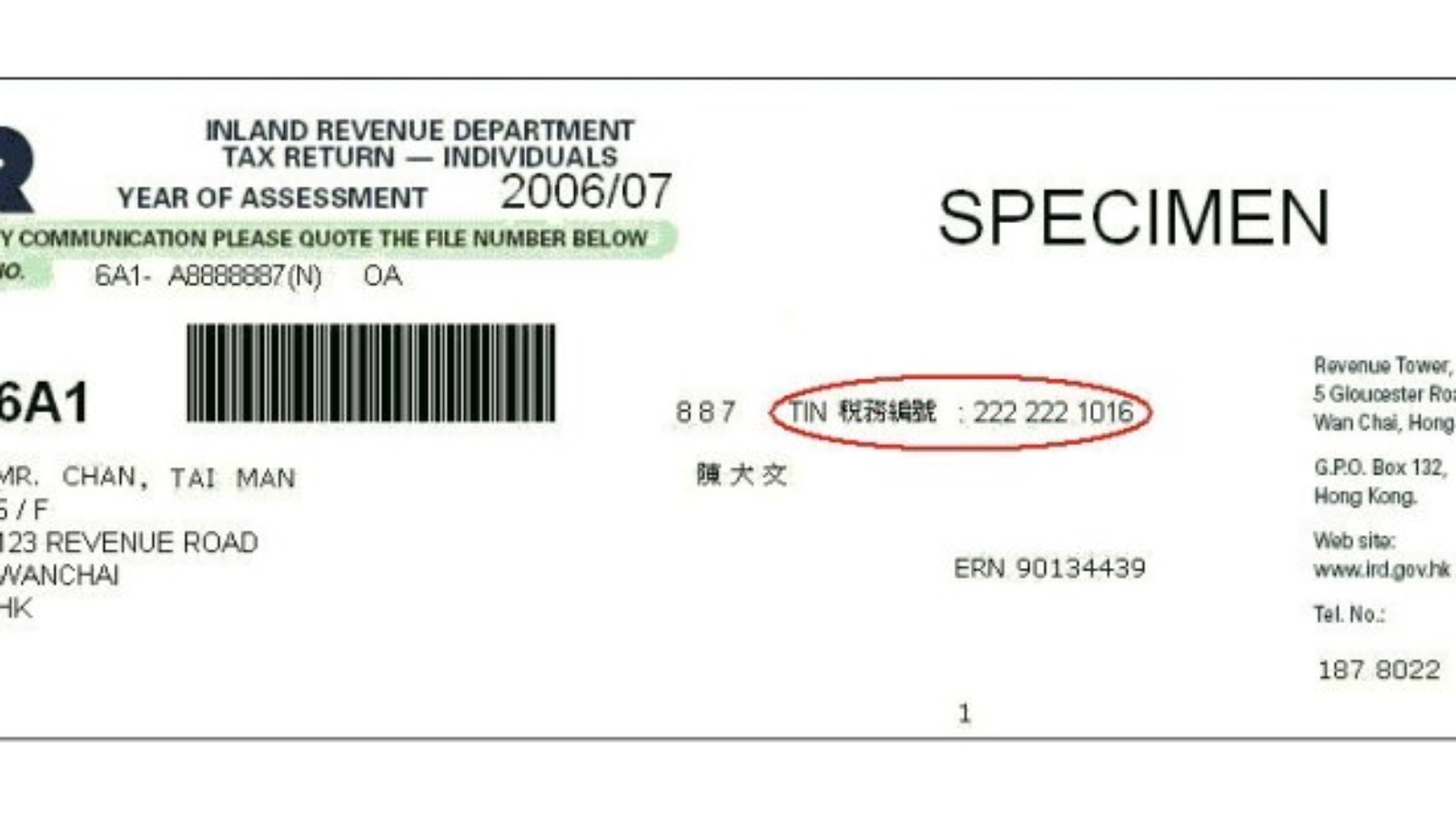

A Tax Identification Number (TIN) is a unique identification number assigned to individuals or businesses for tax purposes. The TIN allows tax authorities to track the tax activities of an individual or business and ensure that they are paying the correct amount of taxes.

Why Banks in Hong Kong are Requesting your TIN Number?

Banks in Hong Kong are requesting TIN numbers as part of their efforts to comply with the Common Reporting Standard (CRS). The CRS is an international tax standard developed by the Organisation for Economic Co-operation and Development (OECD) to combat tax evasion and improve tax transparency.

Under the CRS, financial institutions in participating jurisdictions are required to report information about the financial accounts of their customers who are tax residents of other participating jurisdictions.

This information includes the customer’s TIN number, as well as other identifying information such as their name, address, and date of birth.

By requesting TIN numbers from their customers, banks in Hong Kong can ensure that they are complying with the CRS and avoiding any potential penalties for non-compliance. Additionally, banks can use TIN numbers to verify the identity of their customers and ensure that they are not facilitating any illegal activities such as money laundering or terrorist financing.

How to Provide your TIN Number to your Bank in Hong Kong?

If you are opening a new account with a bank in Hong Kong, you will likely be asked to provide your TIN number as part of the account opening process. If you already have an existing account with a Hong Kong bank and have not provided your TIN number, you may be contacted by the bank to provide this information.

To provide your TIN number to your bank, you can simply provide the number to your bank during the account opening process or when requested. If you are unsure of your TIN number, you can contact your local tax authority or seek assistance from a tax professional.

Conclusion

In conclusion, banks in Hong Kong are requesting TIN numbers as part of their efforts to comply with the Common Reporting Standard (CRS) and improve tax transparency. By providing your TIN number to your bank, you can help ensure that your bank is complying with these regulations and avoid any potential penalties for non-compliance. It is important to stay informed about these regulations and work with your bank to ensure that you are meeting all necessary requirements.